#Official irs letter envelope full#

You can educate yourself on the latest pervasive tax scams with the annual Dirty Dozen report from the IRS.Many IRS letters are confusing and full of technical terms. If you get a plain envelope or something suspicious-looking, it’s probably a fake IRS letter. IRS mail comes in official government envelopes with the IRS logo. Doesn’t arrive in an official government envelope A request for payment in any other way is not legitimate. If you pay by check, it should be written to the U.S. Payments are only made on the official IRS channels, including the IRS website and authorized payment vendors. Request for payment to anyone other than the U.S. While this is technically true, threats of prison time are not included in IRS mailings. The IRS won’t send threatening letters saying you will go to prison or jail if you don’t pay your taxes.

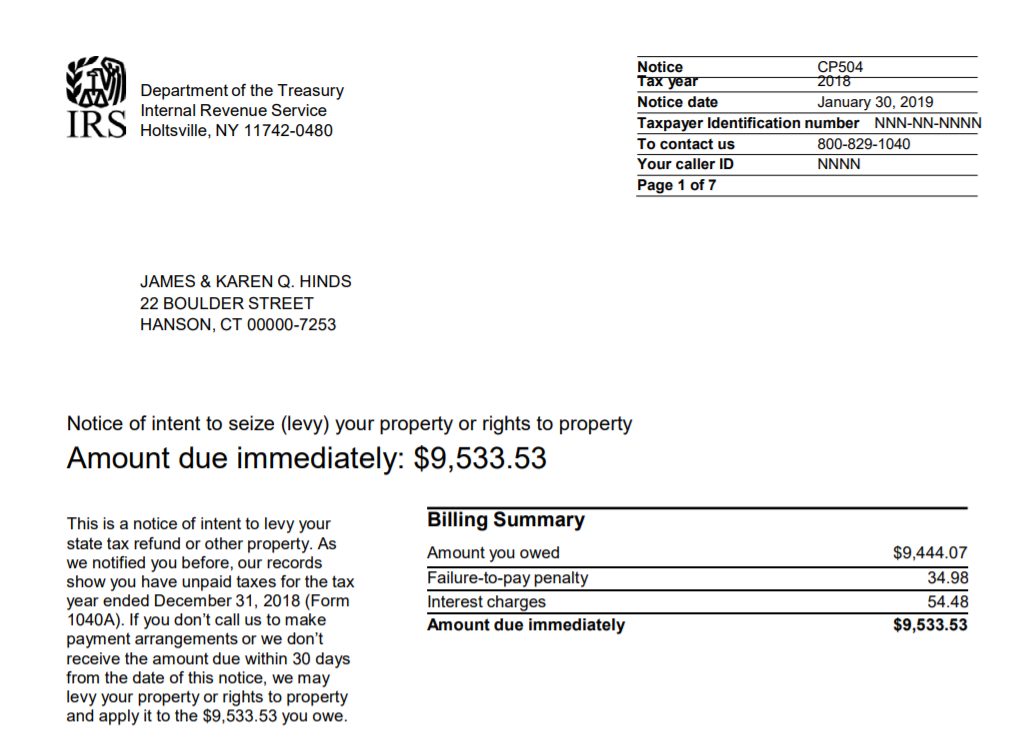

There are no prizes or winnings to be had. You should use a bank account, debit card, credit card, or check for payment. The IRS doesn’t want prepaid cards, iTunes gift cards, or anything other than good old-fashioned United States dollars. Anything involving gift cards or irregular payment methods Fake IRS letters often include high-pressure language demanding you pay immediately. Government letters requesting payment never say that you have to pay right away. IRS letters always use proper spelling, capitalization, grammar, punctuation, and formatting. If it’s text-only with no logo, it’s not an actual IRS letter. If you get a letter for a current tax return you have not filed yet, it’s clearly a fake. Many scam letters go out early in the year while they know people are busy filing. Notice regarding a tax return you have not yet filed

#Official irs letter envelope how to#

If a fake IRS letter shows up in your mailbox, here’s how to spot an imposter and how to respond. To be safe, the IRS recommends keeping tax records for a minimum of seven years in some cases. If you do get any correspondence from the IRS, you should keep a copy of the letter on file until the problem is fully resolved. You can search for that notice type on the IRS website to get specific information to help guide your next steps. Real IRS notices contain a notice number (CP) or letter number (LTR) on the page’s top or bottom right corner.

Before acting, though, take steps to authenticate it. If you get a letter that says it’s from the IRS, stay calm: it very well may be.

If they can get you to call, email, or go to a website, they’re going to do everything they can to separate you from your hard-earned money. You will always get a letter first.įinancial criminals know what IRS letters look like, though, and they go to painstaking lengths to mimic the government agency. The IRS never calls, text messages, or emails taxpayers to notify them of a problem, and they’re definitely not going to send you a message on social media, either. If you get an unexpected phone call from “the IRS,” you should hang up right away.

0 kommentar(er)

0 kommentar(er)